Goldman Sachs 10,000 Small Businesses is a $750 million investment to help entrepreneurs create jobs and economic opportunities by providing them with greater access to education, financial capital, and business support services.

Cincinnati State’s Workforce Development Center was chosen to deliver 10,000 Small Businesses in Southwest Ohio because of our commitment to providing access and opportunity for customized business training.

Financial Strategies to

Strengthen Your Business

Location: Virtual

Cost: Free

Date: Thursday, July 17th

Time: 12 – 1pm ET

Businesses That Qualify

10,000 Small Businesses at Cincinnati State is seeking:

- Owner or co-owner of a business

- Business in operation for at least two years (by the time the cohort begins)

- Business revenues of $75,000 or more in one of the past two fiscal years

- Minimum of at least two employees, including the owner.

Impact Results:

67% of 10,000 Small Businesses alumni increased revenue just six months after graduating; 44% created jobs in the same time frame.

Application Process

The application process for 10,000 Small Businesses at Cincinnati State is a two-step process:

Step 1: Application

- The Application is designed to help us understand you, your business, and why you are interested in the 10,000 Small Businesses program at Cincinnati State. This information will be kept confidential. Once your application is submitted, you will receive an e-mail confirming its receipt and additional follow-up to denote the class (cohort) for which you are being considered. All candidates will be notified regarding their application status, and whether they will advance as a finalist to the interview round. NOTE: Your first visit will require you to create an account.

Step 2: Interview Addendum

- If you are invited for an interview, you will be asked to complete the 10,000 Small Businesses Interview Addendum, which includes additional questions along with a request for the submission of supporting documentation. All information submitted at each stage is private and will be kept confidential.

|

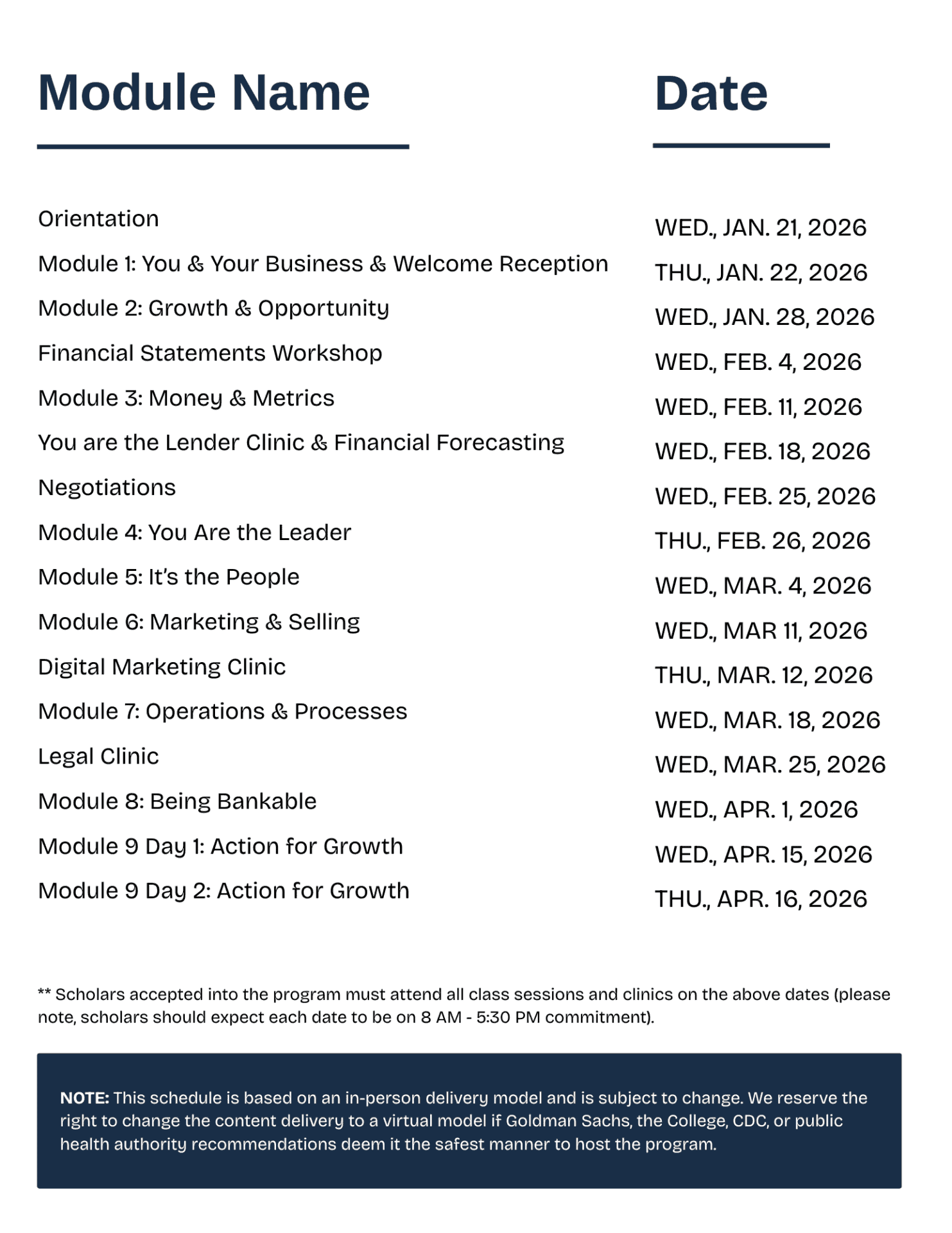

Now accepting applications for the January 2026 cohort!

Any questions, email 10ksb@cincinnatistate.edu.

|

Curriculum Design to Drive Business Growth

The curriculum, designed by Babson College and led by tenured Cincinnati State faculty, focuses on practical business skills that can immediately be applied by business owners, including negotiation, marketing, and employee management.

Participants, known as 10,000 Small Business Scholars, receive scholarships for a 14 session training program on how to grow their business, as well as one-on-one business advising and the opportunity to learn from other like-minded business owners.

| Goldman Sachs 10,000 Small Business Curriculum Model |

| Orientation and Module 1: You and Your Business The opening module will introduce small business owners to the program and the growth plan they will be working toward. After meeting the faculty, business service providers and fellow small business owners, participants will immediately begin working with their peers and participate in exercises that stretch their visions for growth. We’ll discuss the predictable and unpredictable problems associated with growing a business and help participants identify which specific metrics are best for measuring their business’s success. |

| Module 2: Growth and Opportunities Refine and articulate the business growth opportunity. During our second module, we will introduce techniques for identifying and creating opportunities for business growth. Participants will identify sources of innovation for their businesses; develop, analyze and understand the competitive landscape for their businesses and industries; and learn how to determine if a new business concept is a “good idea” or a viable business opportunity. |

| Clinic: Financial Statements This hands-on session is designed to help participants become more comfortable with the three basic financial statements and how to understand and interpret key numbers. In preparation for module three, participants will have the opportunity to conduct a financial analysis. |

| Module 3: Money and Metrics Develop and forecast financial statements for growth. Financial literacy is essential to growing a business. In this module, we will build on the fundamentals of financial statement design and construction. Participants will then assess their business’s financial and operational realities and develop analyses and forecasting methods to best plan and monitor their business’s growth. |

| Clinic: You Are the Lender Participants will take a step into the lender’s shoes to evaluate small business loan applications. We will show participants the red flags that lenders look for and help them prepare the necessary numbers and documents for a loan application. The clinic will also include a panel session with local lenders to answer specific small business questions. |

| Module 4: You Are the Leader Develop and enhance leadership skills. Many small business owners are looking to step out of the day-to-day operations of their business to become a more strategic and effective leaders. In this module, participants will gain a better understanding of how their personal leadership style influences their team and business, and then identify opportunities to enhance or adjust their approach to achieve even stronger business results. |

| Clinic: Negotiations Knowing when to stand your ground and when to budge can make a good deal great. In this clinic, participants will learn the dynamics of negotiation and develop effective strategies to create value through collaboration. |

| Module 5: It’s the People Build and sustain a healthy organization. “It’s the people” focuses on developing employees and building an organization that can both support growth and sustain the participant’s vision for their company. In addition to recruiting and hiring best practices, we offer advice on how to develop a positive business culture that reflects the values and goals of the small business owner. |

| Legal Clinic Meet with local attorneys and discuss the many various legal challenges facing small businesses today. |

| Module 6: Marketing and Selling Understand your customers’ needs. Growth can only occur with strong marketing and sales effort. This module focuses on understanding customers’ needs, target markets, and the competition. We will study the fundamentals of sales and marketing and discuss how to develop and execute an effective marketing plan. This highly interactive module also includes exercises to help participants prepare and deliver a sales pitch and a panel of experts to discuss social media-based marketing. |

| Module 7: Strategic Growth Through Operations Increase operational efficiencies; improve profitability. Processes are central to everything a business does. In this module participants will evaluate their current operational processes, including workflow and logistics, to better understand and map key components of their business’s operations. Participants will also learn how to empower employees to take responsibility for certain processes within operations. |

| Module 8: Being Bankable Financing growth. In this module, we review the different types of financing available to small businesses and help participants understand which funding sources are most appropriate for their business. We discuss the value of maintaining important financing relationships with local institutions and help participants become more “bankable.” In addition to examining the intricacies of raising capital, we take a step back to provide guidance on how to assess and value their company and the resources required for future business growth. |

| Module 9: Action for Growth Sharing the growth plan. During the final session of the program curriculum, participants will have the opportunity to present their growth plans and receive feedback from their business advisors and peers as they hone and prepare to implement their strategies. In this session, we will discuss the role of external business advisors (e.g., mentors, consultants, advisory boards) and introduce the program’s alumni program. We will also revisit possible exit strategies and provide guidance on how to choose among and execute an exit strategy. NOTE: This schedule is based on an in-person delivery model and is subject to change. We reserve the right to change content delivery to a virtual model if College, CDC, or public health authority recommendations deem it the safest manner to host the program. |